Novolipetsk Steel : NLMA-GB: Dividend Analysis : October 12th, 2017 (record date) : By the numbers : October 12, 2017

time2017/10/13

Novolipetsk Steel : NLMA-GB: Dividend Analysis : October 12th, 2017 (record date) : By the numbers : October 12, 2017

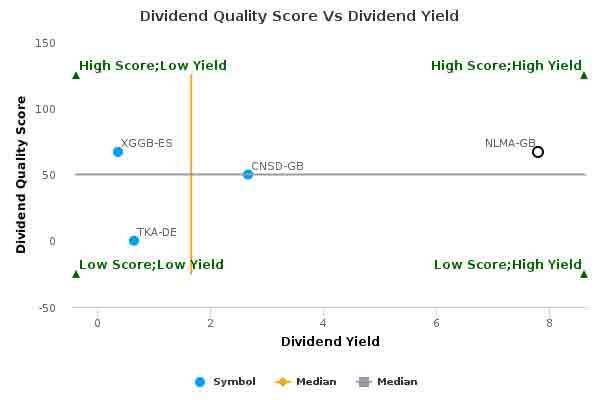

Our analysis is based on comparing Novolipetsk Steel with the following peers – China Steel Corporation Sponsored GDR, thyssenkrupp AG and Gerdau SA Pfd (CNSD-GB, TKA-DE and XGGB-ES).

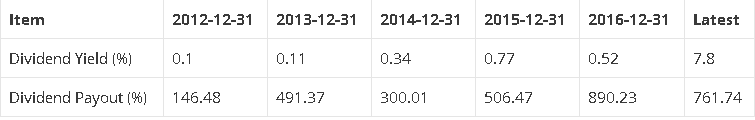

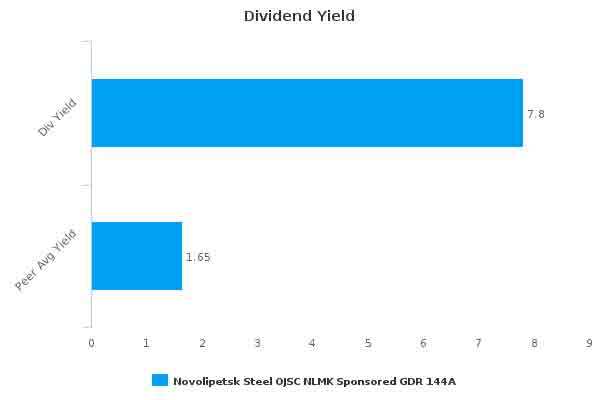

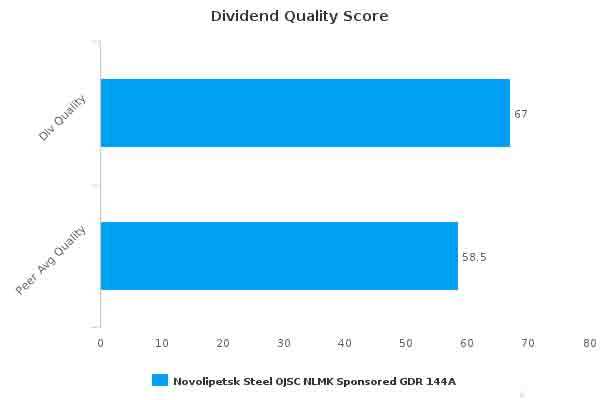

Novolipetsk Steel’s dividend yield is 7.80 percent and its dividend payout is 761.74 percent. This compares to a peer median dividend yield of 1.65 percent and a payout level of 395.29 percent. This type of dividend performance might make it a good stock for dividend investors. In addition, the company’s relatively good dividend quality score of 67 out of a possible score of 100 points to some sustainability of its robust payout ratio, and underscores its attractiveness for dividend investors seeking current income.

Dividend Quality Overview

Dividend quality trend has not been consistent over the last five years. Dividends were paid during each of these years — of these 2 were high quality, 1 was medium quality and 2 were low quality.

The ending cash balance, with a dividend coverage of 1.71x, provides a moderate cushion in case of a significant reduction of cash flows in the future.

Dividend Coverage

Over the last twelve months (prior to June 30, 2017), NLMA-GB paid a high quality dividend.

The source of the company’s cash to support the dividend paid over the last twelve months is operating cash flow (coverage of 1.89x), investing cash flow (coverage of 0.11x), issuance cash flow (coverage of -0.45x) and twelve-month prior cash (coverage of 1.96x), for a total dividend coverage of 2.71x.

NLMA-GB’s issuance cash flow includes outflows from net debt repayment (coverage of -0.52x).

These coverage ratio factors imply that the firm’s dividends are wholly paid from operating and investing cash flows net of any debt repayments, which suggests a high dividend quality.

Dividend History